Understanding the Nasdaq FintechZoom Landscape: A Deep Dive into Financial Innovation

Introduction

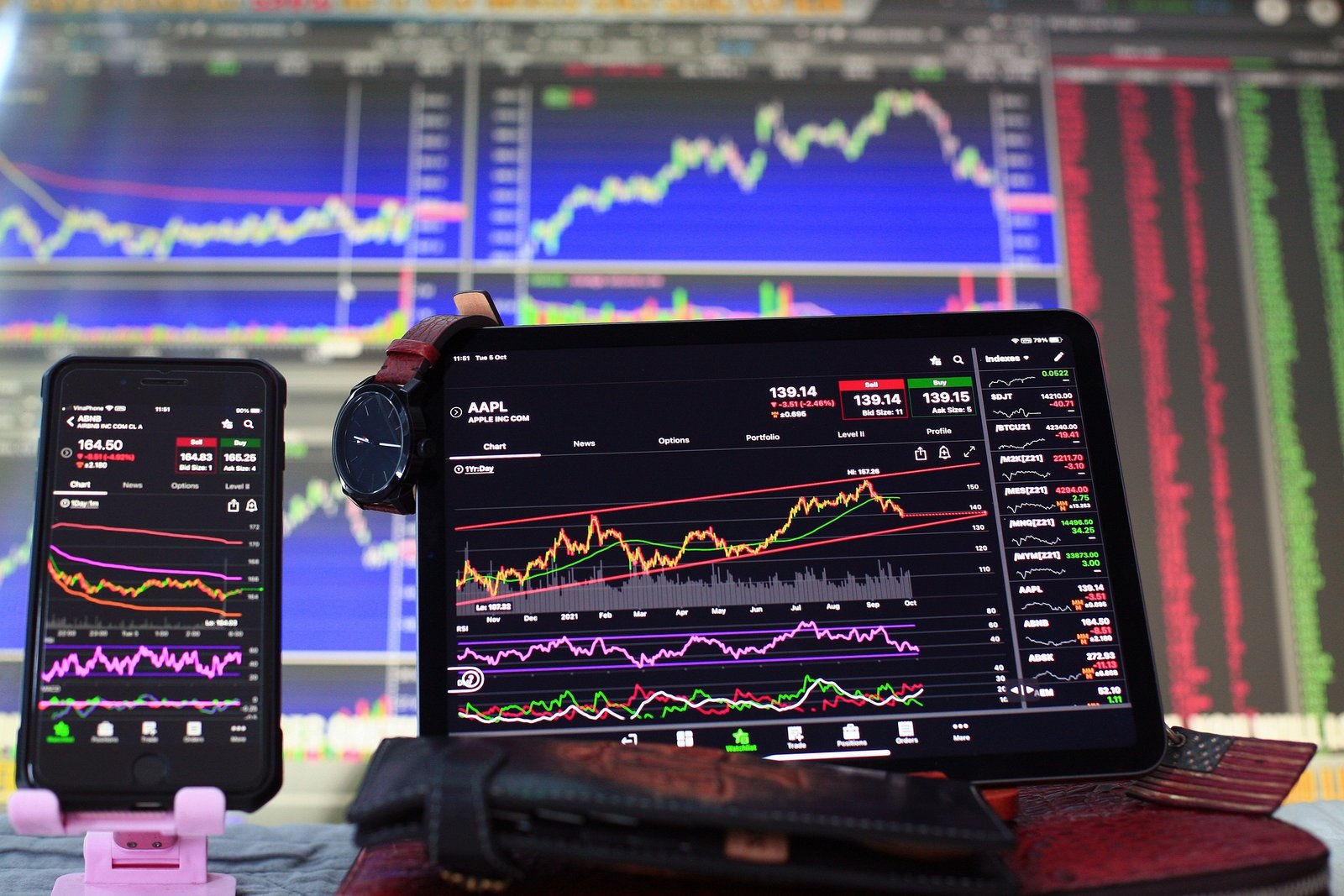

The financial technology sector has revolutionized how we interact with money, investments, and financial services. Nasdaq FintechZoom represents a critical intersection of technological innovation and financial markets, offering investors unprecedented opportunities to engage with cutting-edge financial solutions.

Modern investors are increasingly drawn to the dynamic world of financial technology, where traditional banking meets revolutionary digital platforms. The Nasdaq stock exchange has become a pivotal battleground for fintech companies seeking to disrupt conventional financial systems, making it an exciting landscape for both seasoned and emerging investors.

The Evolution of Fintech on Nasdaq

Historical Context and Growth

Fintech’s journey on Nasdaq has been nothing short of transformative. From traditional financial institutions to innovative startups, the ecosystem has rapidly expanded over the past decade. Companies like PayPal, Square, and Robinhood have demonstrated the immense potential of technology-driven financial services.

Key Milestones in Fintech Development

| Year | Milestone | Significance |

|---|---|---|

| 2010 | First Fintech IPOs | Initial public offerings of tech-driven financial companies |

| 2015 | Mobile Payment Surge | Exponential growth of digital payment platforms |

| 2020 | COVID-19 Acceleration | Rapid digital transformation of financial services |

| 2023 | AI Integration | Advanced machine learning in financial technologies |

Investment Strategies for Nasdaq Fintech Stocks

Evaluating Fintech Investments

Successful investing in Nasdaq FintechZoom requires a multifaceted approach. Investors must consider:

- Technological Innovation: Companies pushing boundaries in AI, blockchain, and machine learning

- Market Potential: Scalability and global reach of financial solutions

- Regulatory Compliance: Ability to navigate complex financial regulations

- Financial Performance: Strong revenue growth and sustainable business models

Top Performing Fintech Sectors

- Digital Payments

- Blockchain Technologies

- Artificial Intelligence in Finance

- Cybersecurity Solutions

- Decentralized Finance (DeFi)

Technological Innovations Driving Fintech

Artificial Intelligence and Machine Learning

Artificial Intelligence has become a game-changer in financial technology. Machine learning algorithms now:

- Predict market trends

- Detect fraudulent transactions

- Personalize financial advice

- Automate complex financial processes

Blockchain and Cryptocurrency Integration

Blockchain technology continues to reshape financial infrastructure, offering:

- Transparent Transactions: Immutable and traceable financial records

- Decentralized Systems: Reduced dependency on traditional banking

- Enhanced Security: Cryptographic protection against fraud

Risk Management in Fintech Investments

Navigating Regulatory Challenges

The fintech landscape is complex, with continuous regulatory evolution. Successful investors must:

- Stay informed about changing regulations

- Understand compliance requirements

- Assess potential legal risks

- Diversify investment portfolios

Investment Risk Mitigation Strategies

- Thorough due diligence

- Balanced portfolio allocation

- Regular performance monitoring

- Long-term investment perspective

Case Study: Successful Fintech Transformation

PayPal’s Journey: From Startup to Nasdaq Powerhouse

PayPal’s remarkable transformation illustrates the potential of fintech innovation. Founded in 1998, the company:

- Pioneered online payment solutions

- Expanded global financial accessibility

- Adapted to emerging technological trends

- Demonstrated consistent growth and innovation

“Innovation distinguishes between a leader and a follower.” – Steve Jobs

Practical Investment Guide for Nasdaq FintechZoom

Getting Started

For new investors interested in Nasdaq FintechZoom, consider:

- Opening a diversified brokerage account

- Starting with ETFs focused on financial technology

- Researching top-performing fintech stocks

- Understanding basic financial metrics

Advanced Investment Techniques

- Analyze company quarterly reports

- Track technological advancements

- Monitor global economic trends

- Utilize advanced screening tools

Emerging Trends and Future Outlook

The future of Nasdaq FintechZoom looks promising, with emerging trends including:

- Quantum Computing in financial modeling

- Sustainable Finance technologies

- Personalized Banking experiences

- Cross-border Financial Solutions

Conclusion

Nasdaq FintechZoom represents more than an investment opportunity—it’s a gateway to understanding how technology is reshaping financial services. By staying informed, maintaining a strategic approach, and embracing innovation, investors can navigate this exciting landscape successfully.

Frequently Asked Questions

- What defines a fintech company?

- How risky are fintech investments?

- Which fintech sectors show most promise?

- How can beginners start investing?

Recommended Resources

- Fintech investment blogs

- Financial technology podcasts

- Professional investment courses

- Nasdaq official resources